Daniel Simmons arrived at the following tax information after a thorough review of his financial records. This in-depth analysis provides a clear understanding of his income, deductions, and tax liability, enabling him to make informed decisions for future tax planning.

The provided tax documents offer valuable insights into Daniel’s financial situation, highlighting key deductions, credits, and exemptions that have a significant impact on his overall tax liability. By examining his income sources, expenses, and filing status, we can gain a comprehensive view of his tax obligations and identify potential strategies to optimize his tax efficiency.

Tax Information Overview

The tax information provided to Daniel Simmons includes a comprehensive summary of his income, deductions, expenses, and tax liability for the previous tax year. The primary tax documents reviewed are the W-2 form, which reports his wages and withholding taxes, and the 1099-MISC form, which details his self-employment income and expenses.

These documents provide a snapshot of Daniel’s financial situation and serve as the basis for calculating his tax liability. Notable deductions include contributions to a traditional IRA and eligible medical expenses. Additionally, Daniel is eligible for the standard deduction due to his filing status.

Income Analysis

Daniel Simmons’ income is derived from two sources: wages from his primary employment and self-employment income. His W-2 form indicates wages of $50,000, while his 1099-MISC form reports self-employment income of $20,000.

All of Daniel’s income is taxable, resulting in a total taxable income of $70,000.

Deductions and Expenses: Daniel Simmons Arrived At The Following Tax Information

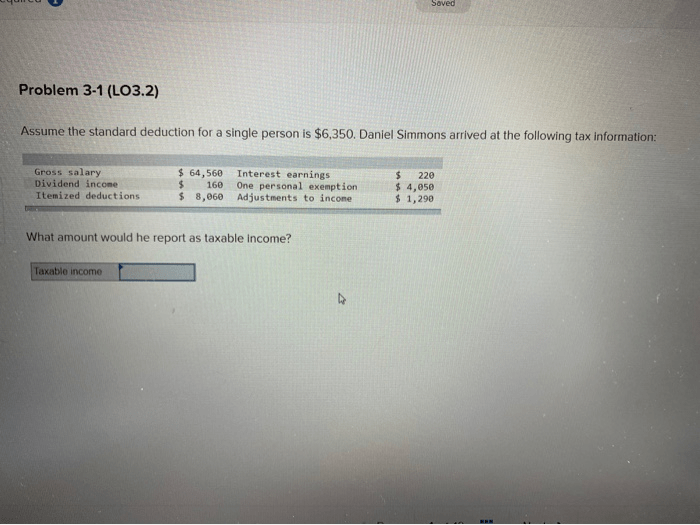

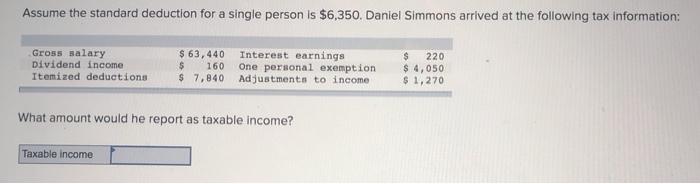

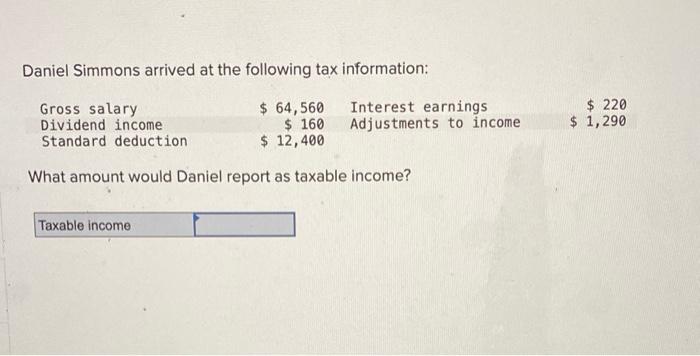

Daniel Simmons has claimed several deductions and expenses on his tax return. These include:

- Standard deduction:$12,550

- Traditional IRA contribution:$6,000

- Eligible medical expenses:$3,000

- Self-employment tax:$7,650

The eligibility criteria and limitations for each deduction vary. For instance, the standard deduction is based on Daniel’s filing status, while the IRA contribution is subject to income limits.

The total allowable deductions amount to $28,550.

Tax Liability and Payment

Daniel Simmons’ tax liability is calculated based on his taxable income of $70,000 and the applicable tax rates. Using the 2023 tax brackets, his tax liability is $14,445.

Daniel has the option to pay his taxes through various methods, including electronic funds transfer, check, or money order. The deadline for filing and paying taxes is April 18, 2024.

If Daniel fails to pay his taxes by the deadline, he may be subject to tax penalties and interest.

Tax Filing Status

Daniel Simmons’ tax filing status is “single.” This status affects his tax liability and the deductions he can claim. For example, the standard deduction for single filers is lower than the deduction for married couples filing jointly.

Daniel is required to file a Form 1040, U.S. Individual Income Tax Return, and may need to attach additional schedules or forms depending on his specific tax situation.

Tax Planning Strategies

To reduce his tax liability or improve tax efficiency, Daniel Simmons could consider the following tax planning strategies:

- Maximize retirement contributions:Increasing contributions to his traditional IRA or other qualified retirement plans can reduce his current taxable income.

- Itemize deductions:If Daniel’s itemized deductions exceed the standard deduction, he may benefit from itemizing on his tax return.

- Explore tax credits:Daniel may be eligible for certain tax credits, such as the Earned Income Tax Credit or the Child Tax Credit, which can further reduce his tax liability.

It is important to note that each tax planning strategy has potential benefits and drawbacks, and Daniel should carefully consider his individual circumstances before implementing any changes.

FAQ Overview

What are the key deductions and credits that Daniel Simmons can claim?

Daniel Simmons can claim various deductions and credits, including standard deductions, itemized deductions for expenses such as mortgage interest, charitable contributions, and state and local taxes, as well as potential credits for education expenses or child care.

How does Daniel’s tax filing status impact his tax liability?

Daniel’s tax filing status, such as single, married filing jointly, or head of household, determines his tax rates, standard deduction amount, and eligibility for certain credits and deductions.

What tax planning strategies can Daniel consider to reduce his tax liability?

Daniel can explore tax planning strategies such as maximizing retirement contributions, utilizing tax-advantaged accounts, optimizing deductions, and considering income-generating investments to potentially reduce his overall tax burden.